ec-Key-nomics

by JD Adler

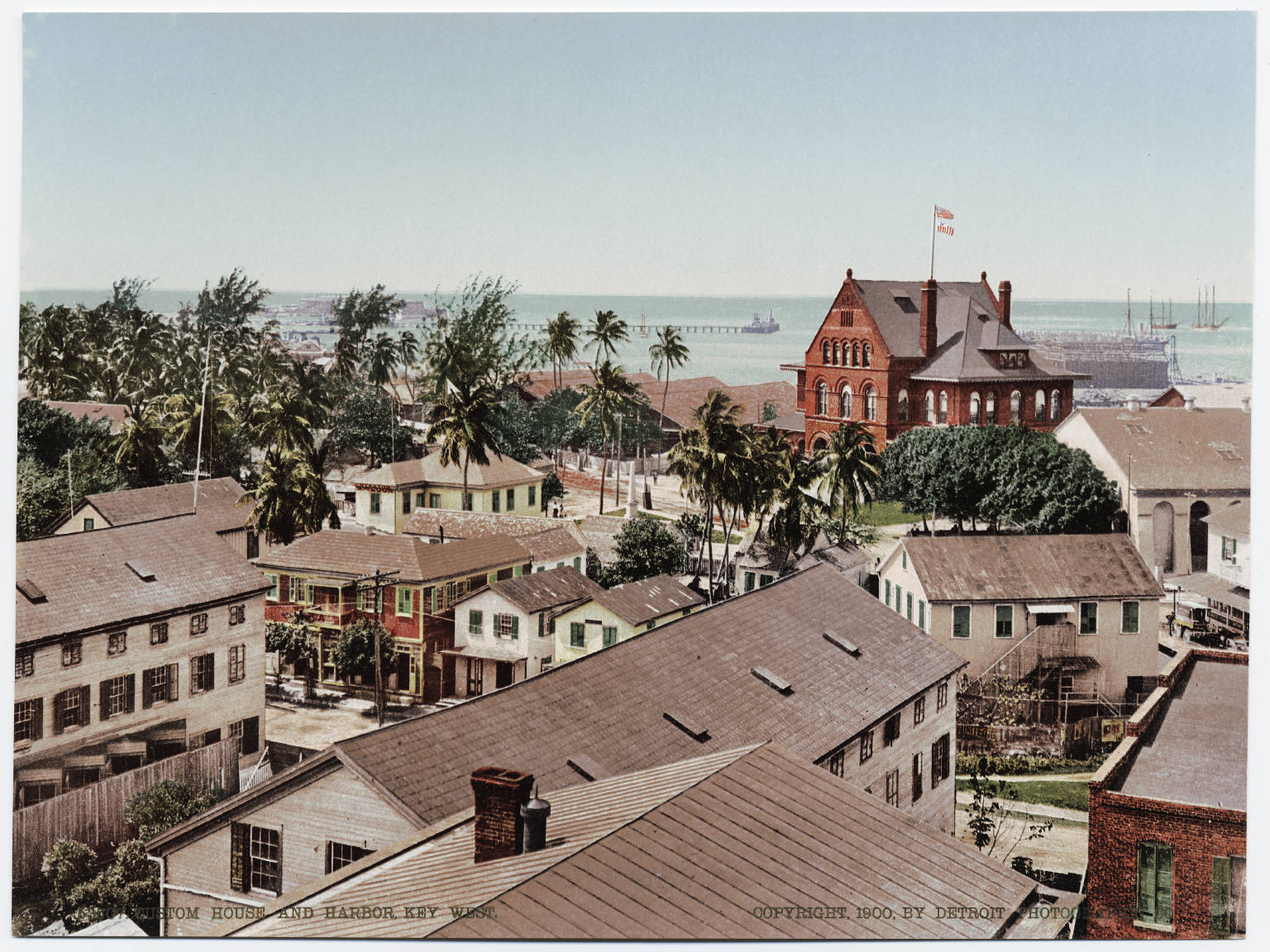

![See page for author [Public domain], via Wikimedia Commons](https://thebluepaper.com///wp-content/uploads/Detroit_Photographic_Company_0298-400x300.jpg)

Spend 5 minutes in Key West and you will learn that there are significant economic issues plaguing the community. A handful of people own most of the businesses and/or property while the workforce struggles to find housing they can afford. This is an issue continuously debated, with little progress made. In fact the situation appears to grow worse over time.

Recently, members of the local government have begun to take a more active role in attempting to alter the situation. They voted down an affordable housing bill, because of bureaucratic technicalities. They have begun to debate whether or not to allow the replacement of trailer parks and with expensive homes or hotels. As these debates gain public notice, some politicians begin to move towards protecting the affordable opportunities for the local population, but no actual legislation has passed as yet. For his part, Mayor Cates has begun to push for an increase in the minimum wage, just as election season begins. However it seems unlikely that the city has the legal authority to even pass such legislation.

When looking at the numbers, income is not actually the problem. The median income in Key West is nearly equivalent to, or better than, the rest of Florida and the USA. The problem is housing costs; both property values for land owners and rent prices.

| Income/year | Med. Property Value | Med. Rent/month | |

| Key West | $31,993 | $457,500 |

$1466 |

| Florida | $26,451 | $170,800 | $987 |

| USA | $28,051 | $181,400 | $889 |

As this chart shows, those living in Key West are earning only slightly more than their neighbors in America, but paying far more for housing. Yet these numbers don’t show significant details. For one, in Key West many people must acquire those incomes through multiple jobs, unlike the rest of the nation. Also, a good portion of those property owners are not primary residence holders in Key West. An elusive number that does not appear to be trackable, yet is a significant source for driving up real estate prices.

As explained to me by the County Property Appraiser, Scott Russell, who also has experience and education in the private real estate market, one of the key components in determining real estate prices for the private marketplace are is the sale price of other properties in the neighborhood. Without getting into the lengthy details: as your neighbor’s house sells, its price affects your house value, which affects the other neighbors, etc. If it sells for more than the last sale in the neighborhood, all values are affected. This round robin affect creates housing bubbles; each sale pushing the price ceiling further upward until it becomes untenable, nothing can sell, and the bubble bursts (apologies for mixing my metaphors). So those who can afford to buy a vacation home, in addition to their primary residence, are pushing property values upwards in our lovely paradise.

As a result, those who own rental properties must pay the bills on properties that are subject to those same market forces. Forcing them to charge rents capable of covering their overhead, while making some profit of course, they did not go into business to become charities. Yet business owners, experiencing the same property overhead costs, must find ways to keep their expenses down and profit up. So wages rise slower than prices.

The result of all this is that the cost of living is dramatically skewed. MIT put out a report describing what they believed individuals and families should need to earn in order stay above the poverty level, per locality based on national numbers. An individual in Key West, they claim, should need $11/hr, while and adult with one child should need $23/hr. However that is based upon a rent estimate of $910/month and $1365/month respectively. Anyone living here knows those numbers are not realistic. In fact, the single person will probably be paying around $1365 for a studio apartment, and therefore need around $20/hr which equals almost $40,000/year. A difficult sum to generate as a employee if you have only one job, add a child to the mix and your costs and time demands have just increased dramatically.

The challenge facing Key West is how to balance these various economic issues. The tourists and snowbirds are fundamental to the economy. So too are the local citizens who supply the work necessary for this to be a place they enjoy. If property values continue to increase, the working class locals will not be able to afford to live here, and then the tourists will have no one to serve them so they will stop coming. At which point, the economy will have an entirely different problem.

Housing PRICES are high. PRICE = DEMAND / SUPPLY.

While there is obviously solid demand, the supply has been kept artificially low. This keeps prices artificially high.

The ‘movers & shakers” in this community are the landlords and landowners: the more housing units of any kind, the lower the rents they can charge and the lower value of their property.

No matter what they say publicly, they control the politicians and rule-making authorities, and they will always be slow and even oppositional to creating more housing units, using both reasonable and unreasonable arguments.

Any other position takes money right out of their own pockets.

Do not forget Balfour Beatty/ Southeast Housing, speaking of out of town owners and corporations, who maintain they do not have to pay property taxes on the 500 units of “military ” housing they own and partially rent out to civilians. They are trying to get a bill through the Florida Legislature right now retroactively exempting all the thousands of units they bought from the Navy in 2007 and undermining the court case our property Appraise has filed for about 12 million in back taxes. That means everyone else pays more while the corporation racks up the profits. All at our expense.

zobop speaks the infuriating awful truth. More proof that our “representatives”, in reality, represent Corporate and could not give a flying fig about the citizens of this state. This applies to DC, as well. To paraphrase Abe Lincoln, “Of the Corporation, By the Corporation, For the Corporation…”

I’m actually surprised that there are places to rent at only $1,200-$1,500 a month. The median KW home sales price is currently $511k. Nevertheless, on any day, no more than 1/2 of the KW homes are occupied.

Mr. Adler, Once again, thanks for the cogent article. One thing I’ve noticed throughout the years in KW (and I suppose everywhere) is that although the bad economic times took some overbloated worth from the real estate market, nothing ever changes in the rental market … the same over bloated prices always going up. Maybe you or someone else could explain why this is so. Thanks again.

thank you for the complement.

I suppose, without doing proper research, its because property owners can choose not to buy a new home, so seller’s have to adjust their prices. However, renters need a home, so they must accept what the landlords’ are charging. And usually, renters can not travel as far afield as property owners, because moving is an expensive business as well. Then factor in that much of the rental property in Key West is owned either by a handful of people or people who don’t live here full time, and you you can see that market forces are just stacked against the tenant.

Mr. Adler, So, might we not be able to say that the people relying on the rental market are simply much more desperate than people looking for real estate opportunities? I mean, it’s a question of having a roof over your head, not just waiting for a good opportunity … or something like that.

I don’t know if I would call us, tenants, desperate. I’m saying if you own property and you want to move, you can sell your current property and have equity for movers and a new mortgage,etc somewhere else. That sort of financial liquidity provides options, and options means leverage.

A renter has their deposit, hopefully, but that will only be a few hundred, maybe a couple thousand dollars. Which allows one to move in a more limited area. Due to the financial costs of moving itself. Fewer options means less leverage in a capitalist negotiation.

Generally, those with less money have less options. (Not exactly breaking news.) In a capitalist system, negotiating power goes to those with the more choices. If there are more buyers than sellers, the seller has the negotiating power. More sellers than buyers, it is a buyers market. Usually.

For Key West renters and landlords it is an unusual situation where the value of property is driven up by external buyers and renters with money to burn, while local renters are being driven out of the market. So technically you do have more buyers than sellers, but not everyone in the marketplace actually lives in the marketplace year round.

Some would argue this requires no solution, it is not a problem, it is just capitalism. Others (like myself) would say, if those participating in creating capital cannot enjoy the benefits of that capital, that is inherently problematic. We are called socialists, though that is not technically accurate.

No one goes into business to give money away. No one gets a job to be poor. There has to be a way to make this work for everyone. Exactly what that is, I don’t think anyone has figured out yet.

Mr. Adler, Very cool, understandable. I think you get to the crux of the matter when you talk about letting the market decide, etc, that is capitalism. And that is exactly what has been the problem since the Industrial Rev kind of invented our current ideas on capitalism. Whenever it is let to follow its natural market inclinations, it leads to a sad distributive panorama, usually leading to some kind of breaking point. I, like you (I’d surmise) believe in some kind of “refereed” form of capitalism, and many of my essays hit upon this subject. Your remarks about the special circumstances in KW (the absentee owners, rich newcomers, etc.) seem plausible to me, and it puts the renter in a worse situation because the market will never react fast enough to their needs and there will always be “scab renters” who will pay more for less to live here, at least for awhile. So, all in all, a difficult problem that once seemed to have a solution in not allowing short term rentals all over the place. The Truman Annex housing was not supposed to be what it has become when the deal was first made. Imagine if all that nice housing could be rented by locals working downtown. That’s a lot of rental units on the market. Siggghhh! God stuff, thanks