The Beginnings Of A Congressional Debacle

by Naja and Arnaud Girard…….

Thursday marked the beginning of a debacle for Florida legislators confronted with Balfour Beatty’s quest to obtain tax loophole legislation. In a move that considerably watered down the tax exemption sought by the privatized military housing industry, the Senate voted to limit privatized military housing exemptions to only those properties that are rented to active military personnel; a compromise that House Economic Affairs Committee members vehemently objected to just last week.

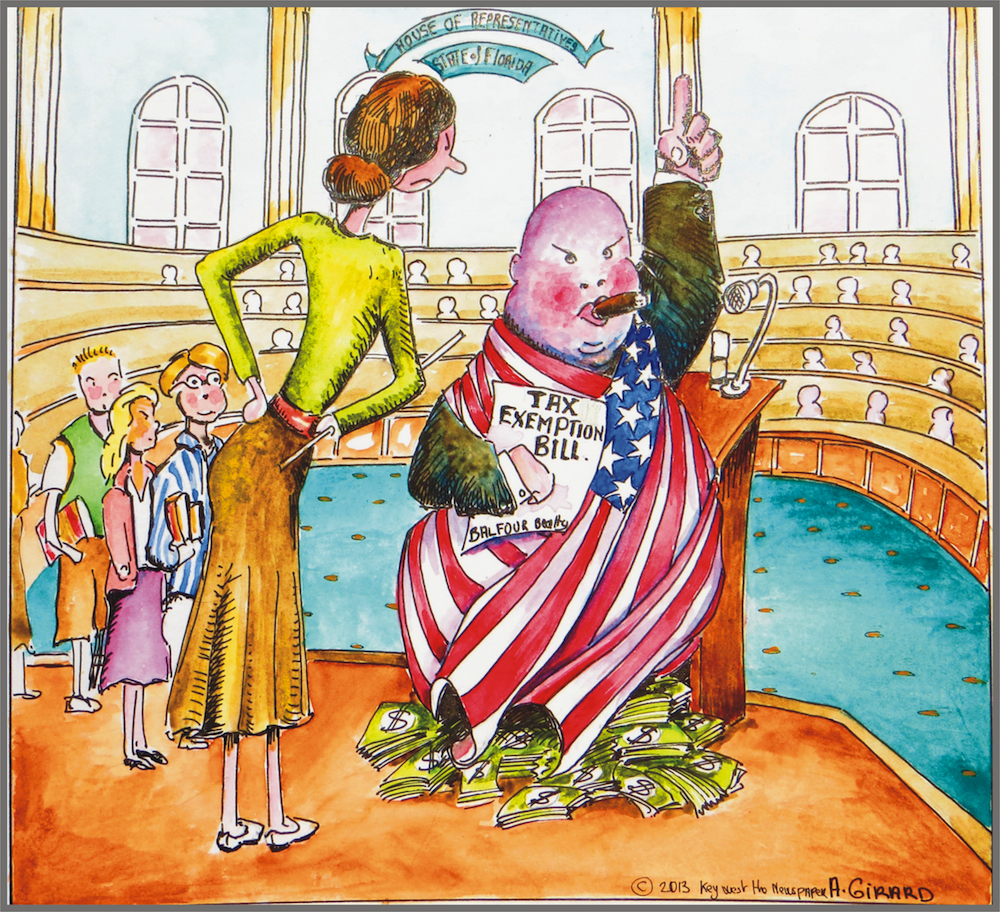

It looks as though the seed of discord has finally been firmly planted. The move by the Senate may just start the ball rolling for an honest debate. Initially, the tax exemption Bills appeared pretty much unstoppable. House Representative Patronis, the Florida Chair for ALEC, proposed a Bill that was echoed in the Senate by Senator Thrasher. Both Bills, aimed at granting generous loopholes to privatized military housing contractors, sailed through from one congressional committee to the next, with nearly every member blindly accepting Balfour’s well-orchestrated account, all nicely wrapped in the American flag and seasoned with an emotional patriotic plea for the sake of our military families. Any reference to practical questions, such as whether companies like Balfour Beatty were in fact competing with private sector landlords and were always meant to pay property taxes would immediately bring none other than Balfour Beatty’s own legal representatives to the podium, who would then charm the legislators with self-serving rationalizations.

But then what happened?

Slowly but surely, Key West became the epicenter of a grass-roots movement. Monroe County Property Appraiser Scott Russel and his attorney John Dent, against all odds, didn’t cave in to the pounding they were receiving from Florida Department of Revenue, House Representative Holly Raschein, or Balfour’s corporate lawyers. Not only did they pursue the recovery of $11.5 Million in back taxes, but they are now clearly pushing the issue of a possible constitutional challenge (if the law ever passes).

Other Florida counties, like Okaloosa County, are now joining the fray. Counties like Santa Rosa are reviewing questionable agreements entered into with Balfour requiring only $12,000/year in taxes on 287 units of housing. Even US Congressman Joe Garcia has now spoken publicly against the tax loophole sought by Balfour.

Former County Mayor Shirley Freeman, one of many landlords in Key West had this to say: “We love our military and always have. What we don’t love is a billionaire multinational corporation trying to steal from us by not paying their property taxes. The rest of us Key West landlords pay full property taxes whether we rent to military or civilians. Balfour Beatty must do the same.”

What is interesting is that we now have the Florida Senate unanimously declaring that the private military housing industry should pay taxes on the units it rents to civilians. Russel expressed his curiosity as to the ramifications of the current Senate version of the legislation, “The fact that the law would be retroactive to 2007 would appear to authorize other Florida municipalities and counties to also go back and assess taxes on all of the units in those jurisdictions that were rented to non-military tenants.”

So, while not a clear victory just yet, there is definitely more than a glimmer of hope.