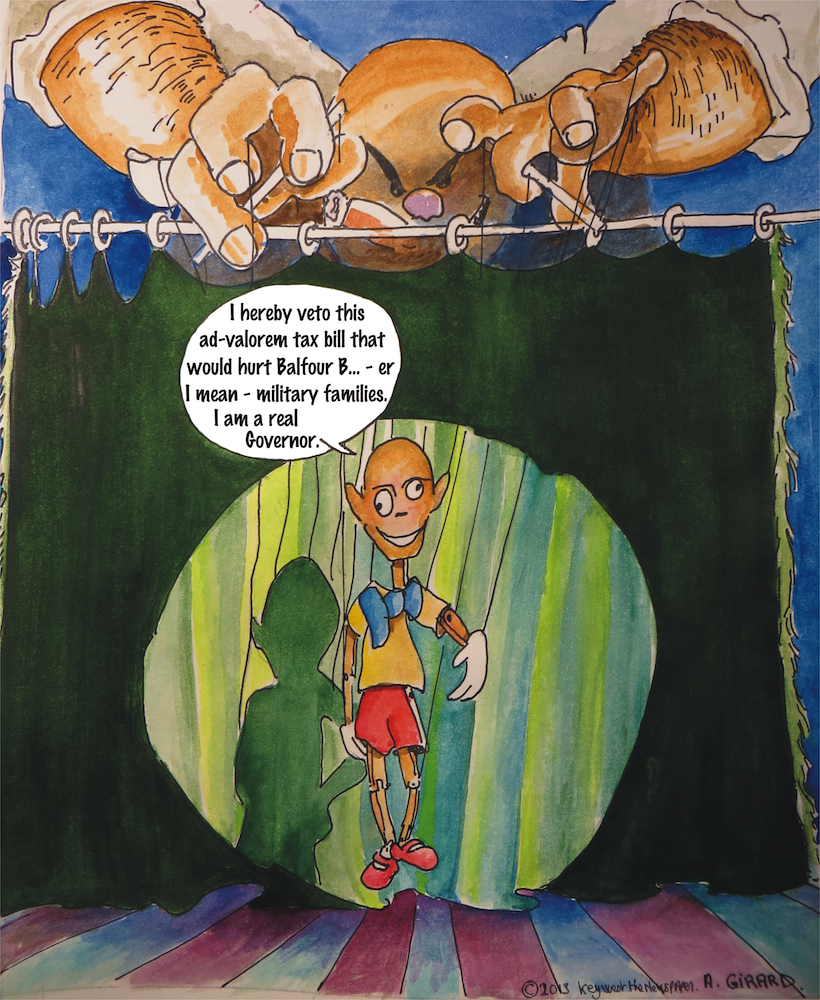

Governor Vetoes Tax Exemption Bill: The Right Decision For All The Wrong Reasons

by Naja and Arnaud Girard…….

Governor Scott has vetoed a tax exemption bill that would have exempted military housing contractors like British mega-corporation Balfour Beatty from paying millions in property taxes on privately owned housing rented to active-duty military.

At first glance you might think Scott had listened to US Representative Joe Garcia’s appeal and realized how unfair and discriminatory that bill was to taxpayers in communities that host these privatized military housing complexes.

But a careful reading of the veto letter shows quite the contrary: the only reason Scott vetoed the amended bill is that it wasn’t quite generous enough to Balfour Beatty (and other military housing developers).

“While the bill, as originally filed, was well-intentioned,” wrote Scott, “a floor amendment may have had the unintended consequence of imposing property taxes on portions of housing developments on federal military installations that are currently fully exempt from such taxation.”

The veto letter has Balfour Beatty written all over it. It refers to the exact same arguments that their lobbyists have been peddling for a year.

What’s puzzling is the fact that the amended bill was still better than nothing. After all, it did exempt Balfour Beatty/Southeast from paying property taxes on units used for active-duty military housing.

The key is to remember that Balfour Beatty subsidiary Southeast Housing LLC is currently being taxed on its local housing property. While it has filed a claim challenging the validity of the $11.5 Million lien for back taxes placed on its Key West properties, it could very well lose the case. So why not take advantage of the exemption offered by the legislature? Why this gamble that includes the possibility of having to pay two or three times as much for all of its Florida properties (if they are unsuccessful in their suit)?

One can only speculate that for Balfour, perhaps paying even a third of their property taxes is considered too much. And the reason could be that in fact Southeast Housing may already have one foot in the grave. According to Moody’s, the credit analyst, Southeast Housing is close to one-half billion dollars in debt and has had so much difficulty in meeting its debt service obligations that the Navy had to bail it out last year with over $8 million in cash.

According to Balfour, a major problem has been a lack of occupancy. But according to a June 2012 report by Moody’s, the problem also stems from Southeast Housing having paid Balfour Beatty Construction way too much for demolition. In other words Balfour paid itself too much for the work with the highest profit margin but which doesn’t directly generate any increase in rental income.

Southeast Housing is already on life support. The “rescoping of the project” they are hanging onto is nothing less than a bailout by the US Navy. “Contractor got into financial trouble by mismanagement,” wrote Captain Aaron Bowman, Commanding Officer, Naval Station Mayport in one email, “USN gives up right to property that it has owned for well over half a century, contractor takes proceeds and continues as if nothing happened and realizes that if they get in trouble again there might be opportunity to get more land from the navy to sell off…”

Selling rental property like Peary Court may simply push Southeast Housing closer to the abyss. The rental income is what guarantees reimbursement of the debt. Yes, the sale of Peary Court will provide a temporary balloon of oxygen, but as the amount of rental units shrinks so does the rental income and pretty soon Balfour could be back to having to sell more Navy land, entering a vicious cycle where it will need to sell more of its rental units because it sold more of its rental units.

Echoing Bowman’s prediction, our investigation has revealed that Balfour Beatty also made moves toward selling the old Medical Clinic housing on the corner of South Roosevelt, near the Cow Key Channel Bridge. We also recently received a tip that the waterfront property (the Truman housing) next to Southernmost Point is being emptied out. Might it be next on the chopping block?

It is hard to know what is really going on because everything that concerns money and Balfour Beatty comes back from the Navy heavily redacted. Our Freedom of Information Act documents come to us full of black squares blocking all of the financial details. Even though Balfour would like the rest of us to pay their share of property taxes (claiming they fulfill a governmental function) they never miss an opportunity to interject their “private business” status to block the public records law.

We asked a banking expert why Balfour might take such a gamble on property taxes. What we learned was that timing might be everything in this case. Balfour Beatty is still in the middle of its bailout/rescoping maneuver, and this certainly must enerve the bank that’s holding the half-billion in debt. Now, if the bill had not been vetoed and even though it only required taxation of non-military housing, tens of millions of dollars in back taxes would have suddenly been added to Southeast Housing’s financial stress. The lender might have begun to seriously question Southeast Housing’s ability to pay back the debt, gone into ‘self-preservation mode’ and blocked Balfour’s access to bond deposits. Ultimately it could have led to the end of the road for Balfour’s Southeast Housing. In its Southeast Housing venture, Balfour seems to be in a race against time, and time, perhaps at the risk of having to pay much more later, is what Governor Scott’s veto is providing.

Balfour has now placed ‘all of its eggs in one basket’. Everything depends on the outcome of the case they filed in Judge Audlin’s court against Monroe County’s Property Appraiser. They will need to convince Audlin, during the trial set for November, that they are not the “real” owners of the 895 units of housing in Key West and therefore should not be required to pay property taxes like other residential property owners. However, as we previously reported, this argument was defeated in a similar landmark case in St. Clair, Illinois.

Time will tell, but it may have been foolish for Balfour Beatty to have rejected the very generous partial tax exemption offered by the Florida Legislature.

EDITOR’S NOTE: A previous version of this article mistakenly attributed the following quote to Christopher Carson of Naval Facilites SE. The statement was actually made by Aaron Bowman, Commanding Officer, Naval Station Mayport:

“Contractor got into financial trouble by mismanagement, USN gives up right to property that it has owned for well over half a century, contractor takes proceeds and continues as if nothing happened and realizes that if they get in trouble again there might be opportunity to get more land from the navy to sell off…”.

See our back issue coverage of this topic here.

[optin-cat id=”26188″]