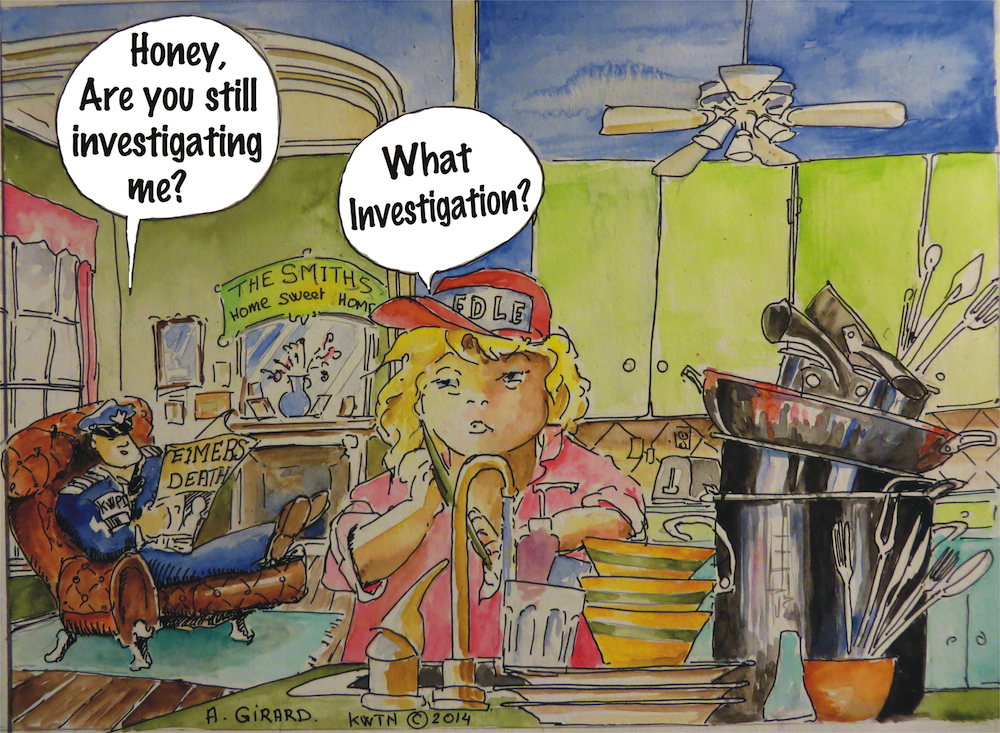

Mortgage Fraud Investigation of FDLE Agent Kathy Smith Ongoing

by Naja and Aranud Girard

The home that landed FDLE Agent Kathy Smith in the center of a mortgage fraud investigation is now being foreclosed on. We learned this week that on December 15, 2014, Capital One N.A. filed a foreclosure action against the home on 1 Emerald Drive in Big Coppitt. According to a local financial analyst [who asked to remain anonymous] any potential charges that may be filed against Agent Smith could become more serious if the lender ends up suffering a loss after foreclosure.

The particulars of the alleged fraud would have likely never come to the surface had Kathy Smith not been the FDLE agent in charge of the controversial investigation into the in-custody death of Charles Eimers.

After the Thanksgiving Day fatal arrest involving almost a dozen Key West police officers, the Blue Paper repeatedly reported that witnesses complained of being unable to give their statements to FDLE. Agent Kathy Smith took 6 months to finally agree to interview witnesses who said they had left repeated messages on her answering service. One key witness from Maryland never received a return call at all but found the family’s attorneys on her own after viewing the CBS News coverage about the case last May.

FDLE also failed to investigate the suspicious near-miss cremation of Eimers’ body before autopsy, and made no attempts to obtain the damning second bystander video, even though it was just a phone call away. Finally, the medical examiner, who conducted the autopsy and concluded the death was accidental, testified last month that he may have been misled by information furnished [or withheld] by FDLE’s Agent Kathy Smith.

When looking into the apparent obstructionism by FDLE in the Eimers investigation, The Blue Paper discovered that Kathy Smith was in fact the ex-wife of then KWPD Captain Scott Smith, who at the time was the direct supervisor of the group of officers Agent Smith was meant to investigate in Eimers’ death.

Later it was discovered that the Smiths had apparently perjured themselves during a mortgage application process in 2010, claiming under oath that they were currently married when in fact they had finalized their divorce some 4 months earlier.

FDLE supervisors were well aware of the conflict of interest but claimed they had a system of checks and balances that would ensure the integrity of the investigation, even though their written policy prohibited the situation. Kathy Smith was allowed to present her Eimers investigative report to the State Attorney who used it to steer the Grand Jury away from indicting the officers. Subsequent to the Blue Paper report, Kathy Smith was put on administrative leave pending an investigation into mortgage fraud.

The burning question is how long will it take FDLE to investigate those two pieces of paper: one where the Smiths swore under oath they were still married and one that shows the divorce they’d asked for had been finalized 4 months earlier.

Under Florida Statute 817.545 Mortgage fraud.—

(2) A person commits the offense of mortgage fraud if, with the intent to defraud, the person knowingly:

(a) Makes any material misstatement, misrepresentation, or omission during the mortgage lending process with the intention that the misstatement, misrepresentation, or omission will be relied on by a mortgage lender, borrower, or any other person or entity involved in the mortgage lending process; however, omissions on a loan application regarding employment, income, or assets for a loan which does not require this information are not considered a material omission for purposes of this subsection.

(b) Uses or facilitates the use of any material misstatement, misrepresentation, or omission during the mortgage lending process with the intention that the material misstatement, misrepresentation, or omission will be relied on by a mortgage lender, borrower, or any other person or entity involved in the mortgage lending process; however, omissions on a loan application regarding employment, income, or assets for a loan which does not require this information are not considered a material omission for purposes of this subsection.

(c) Receives any proceeds or any other funds in connection with the mortgage lending process that the person knew resulted from a violation of paragraph (a) or paragraph (b).

(d) Files or causes to be filed with the clerk of the circuit court for any county of this state a document involved in the mortgage lending process which contains a material misstatement, misrepresentation, or omission.

If convicted punishment can be for a term not to exceed 15 years. A similar federal statute provides for up to 30 years imprisonment and $1,000,000 in fines.

Cover-up has become FDLE’s middle name: an in-depth investigation by the Miami Herald evidenced a rash of horrific in-custody deaths in the Florida prison system which FDLE systematically failed to properly investigate. Last month, Department of Law Enforcement Commissioner Gerald Bailey was asked to resign by governor Rick Scott and was recently replaced by Rick Swearingen.

Captain Scott Smith has since resigned from the police department and now works as an investigator for the Public Defenders office. Will his allegiance be to the homeless, the poor, and the African American people seeking the help of the Public Defender when railroaded by overzealous cops or to his former fellow brethren at the police department?

DID YOU LIKE THIS STORY? SUPPORT THE BLUE PAPER

Help us continue to bring you local investigative journalism… Click on the image to make a donation [NOT tax deductible].

As they often say, “You just can’t make this s**t up!”

Somehow, i don’t think Capt. Scott (KWPD, ret.) is going to make a good investigator for the Public Defender! However, it should help the conviction rate.

How competent can the FDLE be that they cannot conclude mortgage fraud, given a signed & dated sworn statement and Clerk of the Court public records on line? How long will that paid administrative leave last?

it is clear that the FDLE does NOT exist to monitor, investigate, and hold police accountable on the public’s behalf. The FDLE’s mission is to make believe they are investigating, while actually abetting the cover-up, while forestalling other, legitimate investigations, which are put on hold until the supposed master FDLE “investigation” is done. The longer FDLE stalls, taking for example how long to “investgate” two, PUBLIC, SIGNED statements for this mortgage fraud, the more witnesses forget or disappear.

For example, the only excuse for officer perjury about Eimer’s standing up is that it was so long ago that their memories failed them. Way to go, FDLE! Mission accomplished!

Note how material the fraud was. Married people are generally more fiscally dependable. Divorce wreaks havoc on a couple’s resources. They took a gamble on real estate, got the mortgage fraudulently, and now the bank is out the money when their gamble failed.

Hasn’t perjury been a way of courtroom life in Key West, Florida?

There is no question they lied but I fail to understand why. Whether married or divorced the same two people would be on the documentation. My only explanation would be that lying is a pattern with them. There should not be any benefit for being married.