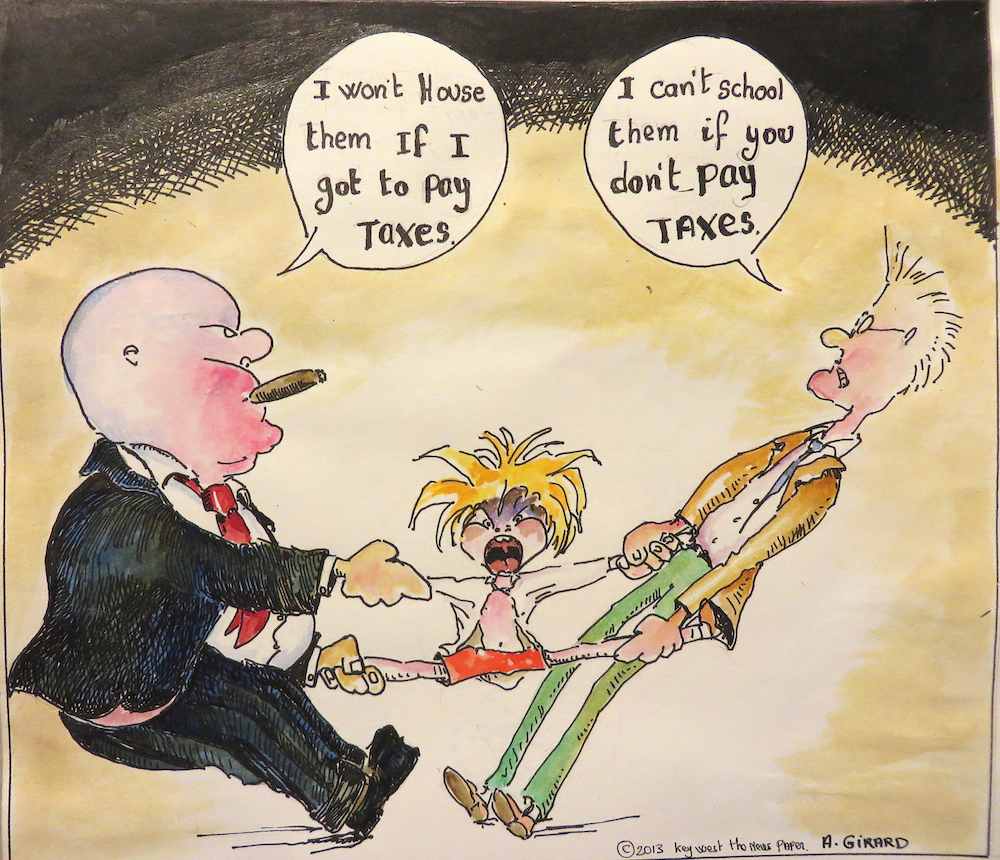

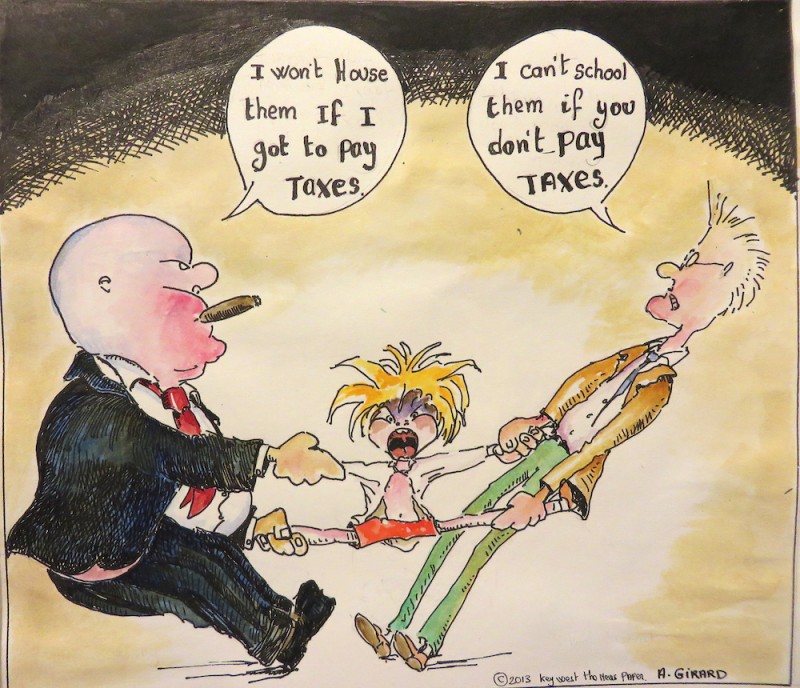

TAX LOOPHOLE WOULD HELP BALFOUR BEATTY BUT HURT CHILDREN OF MILITARY FAMILIES

Last Tuesday the Monroe County School Board voted unanimously to voice their opposition to the local tax loophole sought in the Florida legislature by private military housing contractor Balfour Beatty.

The resolution came as no surprise, since public school students are bound to be the biggest losers if a tax exemption is adopted. Of the $ 11.5 M in back property taxes owed by Balfour Beatty, about 1/3 would go to the school district. In Monroe County 80% of public school funding comes from property taxes. Funding has been so low in recent years that last year’s budget cuts were in the neighborhood of $6.2 M.

Interestingly enough one of the biggest stresses on our school budget is the schooling of military children. According to Jocelyn Bissonnette of the National Association of Federally Impacted Schools (NAFIS) in Washington D.C., Monroe County spent $1.8 M last year to take care of students living on exempt federal property.

The paradox facing state representatives regarding Balfour Beatty’s tax exemption is that one of the important arguments in support of the Military Housing Privatization Initiative (MHPI) was that it would help provide better education for military children by having military housing properties begin to contribute to the local tax base and thus the local school system.

Of the $1.8 M spent last year, Monroe County received only $240,000 in “federal impact aid” to compensate for the lack of property taxes. The situation is even worse in some other counties, like Brevard County where the unfunded cost for schooling military children has topped $4 million.

The problems associated with lack of funding for schools in communities hosting military bases is not a concern reserved for civilians. The National Military Family Association (NMFA) complains, “the presence of a federal military activity in a school district increases enrollment, yet it reduces the tax base by removing property from the tax rolls.” Public school budget deficits impact civilians and military families alike by reducing the number of teachers and classes and the overall quality of education.

The tax deficiency was one of the issues that privatization of military housing was meant to resolve. “One Navy Housing plan,” said Rame Henstreet, commanding officer of the Naval Facilities Engineering Command Midwest (to The Chicago Tribune in 2005), “includes a way to generate property taxes for communities and schools by allowing a developer to replace the homes, then lease them back to the military. The home would be taxable, but not the land, which would still belong to the military.”

Unfortunately, the intended benefit to all Monroe County children, whether from a civilian or military family has been suppressed as a result of Balfour Beatty’s failure to inform the Monroe County Property Appraiser of the 2007 transfer of 890 housing units from federal to private ownership. Balfour, by lobbying the Florida legislature for a tax exemption, is attempting to undermine one of the most important benefits of the MHPI.

While in Key West in late March, US Representative Joe Garcia spoke with Key West The Newspaper about his concerns regarding the military housing tax loophole. Congressman Garcia has since written to Ray Mabus, the Secretary of the Navy, asking for affirmation that the intent of MHPI was not to exempt the private military housing industry from local property taxes.

“It is my understanding that at the time [2007] the Navy made clear to Balfour that full property taxes would be applicable on all privatized housing, including those occupied by military personnel and local civilians,” wrote U.S. Representative Garcia.

…

“What’s fair is fair – a single for-profit company should not be exempt from local property taxes yet still benefit from the community’s investments in law enforcement, infrastructure, and other services while companies just down the road pay their fair share.”

Balfour Beatty’s attorneys continue to argue that the only way the company can provide decent housing to military families is by getting a tax exemption; but KWTN has received credible information revealing that even if the company were paying full property taxes it would still end up with a monthly profit of $100,000, from its Key West operation alone.

Facebook Comments