Peary Court Purchase Plan B and the Cornfeld Group

by Martha K. Huggins, Ph.D……..

Commissioner Jimmy Weekly has announced a “Plan B” for the City’s involvement in Peary Court: A “family business” is interested in purchasing Peary Court with Key West City government kicking in 12.5 million in Land Authority money to sweeten the deal. For its $12.5 million portion of the Peary Court purchase, Key West government would lock the Robert Cornfeld “family business’” into a deed-restriction requiring that existing Peary Court properties be dedicated in perpetuity to ‘affordable’ rentals—that is, “affordable” for better-off workers. Apparently, there is no deed stipulation that Peary Court’s prospective buyers not build totally new up-scale housing on the property. [Rents at the high end “middle-income affordable” rate could be as high as $2709/month for a 2-bedroom.] And there is certainly no provision that Peary Court’s rents be “affordable” for the poorest of Key West’s wage workers. Jimmy Weekly’s “Plan B,” as it is being worked out, again signals our Commissioners’ operational definition of “affordable housing”: A housing plan that uses at least some local government funding to enhance the life-quality of middle-income employees, with no contribution from the local and (inter) national businesses here. They consistently under-pay their workers in order to enhance their own business profits and then look to government to help close the wage gap.

The Cornfeld “Family” Business: Images and Realities

I know family businesses when I see them; the Cornfeld Group is not one–except for being a family-run conglomerate. Having between 17 and 32 “family owned” limited liability corporations, the Cornfeld Group is way more structurally complicated than real local “family- owned” businesses. The Cornfeld Group is not Key West’s “Sandy’s” Cuban eatery nor is it Jimmy Weekly’s Fausto’s Food Palaces. Robert M. Cornfeld, the founder of the Cornfeld family’s corporate empire–a former orthodontist–is president of the largest share of Cornfeld Group corporate entities. Jeffrey (AKA: Jeffry) heads the remainder of his father’s corporations. With executive offices at 3850 Hollywood Blvd, Hollywood, Fl., the Cornfeld Group and most of its associated corporations seem to share the same geography with one another—a rather average-sized corporate office space. The corporations’ lawyer and advisor, Franklin L. Zemel, is a University of Miami-trained lawyer and partner at Arnstein & Lehr LLP, which operates out of Ft. Lauderdale. Given that Attorney Zemel oversees an extensive number of Cornfeld Group corporations,(2) one must assume that he and his law firm are the go-to people within Robert Cornfeld’s financial domain.

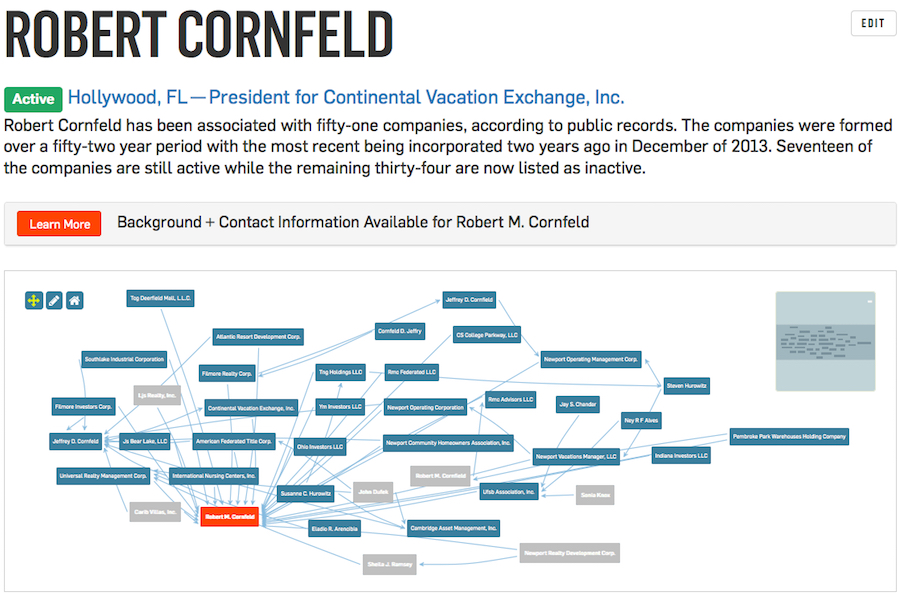

The Cornfeld Group—a corporate umbrella of family-owned corporations tightly run by Robert Cornfeld himself—is no less of a corporate behemoth than the “White Street Partners” who now own Peary Court (see Huggins, “Who Owns Peary Court?”). Both conglomerates have large networks of interlocking corporate entities, backed by corporate LLC legal powers, protected by lawyers, and sheltered by secrecy. According to “Corporationwiki,” Robert Cornfeld “has been associated with fifty-one for-profit family-owned companies [, formed] over a fifty-two year period with the most recent being incorporated two years ago in December of 2013. [At least] seventeen of the [51 Cornfeld] companies [are] still active…. In one of the Cornfeld companies–TNG Holdings— Robert Cornfeld is simultaneously, President, Director, Treasurer, and Secretary. Does anyone else find this overlapping of executive roles a questionable management model? For a diagram of Robert Cornfeld’s corporate holdings,(4) click here.

What do Cornfeld Corporations Do?

The Cornfeld Group is far more inaccessible to peering eyes even than “White Street Partners”: I found it literally impossible to locate more than the most superficial information about Cornfeld’s various companies. Missing from cyberspace is what each corporation specifically does, for whom, and toward what end. Sometimes a corporate entity’s name seemed mis-attributed, such as Cornfeld’s American Federated Title Corporation (AFTC), which has been described as “a small organization in the miscellaneous retail stores industry located in Hollywood, FL…[with] approximately 11 full-time employees and generates an estimated $1.2 million in annual revenue.”(5) Being a “Title” corporation, in this case, seems to mean that the Cornfeld Group earns revenues from properties to which it holds titles, rather than a business that primarily carries out title searches (see also http://business-finance-restructuring.weil.com/wp-content/uploads/2015/10/Am-Fed-Title-Corp-v-GFI-Management.pdf). For more of, what’s in a name, several of Cornfeld’s corporations use alphabet letters only, which would not be a great problem if information existed somewhere to describe these ‘alphabet soup’ corporations’ business activities.

How would any potential client know whether to procure one or another of the Cornfeld Group’s corporate services? And who would do business with a corporate conglomerate offering no information about its operations? But apparently, “Plan B” Key West Commissioner, Jimmy Weekly, is quite satisfied doing so in the absence of such information. In the end, one is left very uninformed, with Attorney Zemel left to explain “matters” to Key West’s Mayor and Commissioners. It is clear that the Cornfeld Group has achieved a very high level of self-sufficiency: it has family-owned corporate resources in finance (Filmore Investors, Cambridge Asset Management Corporation, LJS investors, LLC); holding companies (Hollywood Real Estate Holding Company, TNG holdings); real estate management (Universal Realty Management Corporation [Eladio Arencebia, VP] and the Filmore Realty Corporation); and business consulting services (JDC Partners). But as Disney’s “Wile E. Coyote,” says, “That’s All Folks!”: I cannot tell you what’s not there about the Cornfeld Group–the corporate entity that apparently lures the support of some Key West “Plan B” Commissioners.

Family Businesses: For the Family or the Larger Collective?

In political scientist Edward Banfield’s 1967 book, The Moral Basis of Backward Society—a study of Southern Italy’s Chiaromonte Village, a town dubbed by Banfield, “Montegrano”—the political scientist describes village society there as a ‘family-centric, self-interested social microcosm, within which the public good was viewed as secondary to nepotism and immediate family benefits.’ Pointing to this as placing family interests over those of the larger citizenry, Banfield called such actions, “amoral familism.” Banfield, a Cold War conservative, was therefore loath to compare the wider corporate roots of ‘a-morality’ to what he recorded in the small Italian village. Yet those who romanticize “family” businesses as somehow more socially compatible than corporate ones, need to consider the tendency of family businesses to see their own family’s good fortune as preeminent over community interests. Let’s hope that Key West Commissioners will work together with their critics to solve our city’s crisis of un-affordable housing before they enrich the bank accounts of those whose zero-sum economic approach to wealth blocks possible life quality gains by poorer KeyWesters and their allies.

~~~~~~~~~~

Endnotes

1 http://mobile.cornfeldgroup.com

2 (https://visulate.com/rental/visulate_search.php?CORP_ID=L15000072126),

3 https://thebluepaper.com/who-owns- perry-court/

4 For those Cornfeld companies in which Jeffry Cornfeld is President, click on,

www.corporationwiki.com/Florida/Hollywood/jeffrey-d- cornfeld-6521407.aspx.

5 http://listings.findthecompany.com/l/21495415/American-Federated- Title-Corporation- in-

Hollywood-FL; (see also http://business-finance- restructuring.weil.com/wp-content/uploads/2015/10/Am-Fed- Title-Corp- v-GFI- Management.pdf)

DID YOU LIKE THIS STORY? SUPPORT THE BLUE PAPER

Help us continue to bring you local investigative journalism… Click on the image to make a donation.

If the Cornfelds, with $12.5 million from the City of Key West, purchase Peary Court as “affordable housing” or “workforce housing”, who will live there? Will the current tenants continue as residents or will they be evicted for a lower income group? Either way, it does not strike me as a good use of public money–subsidizing the affluent or dispossessing them for another less affluent group.

Actually as was brought up it is questionable as to who will be living there. Nothing I heard would stop him from selling units. That could easily turn this into second homes for the rich that in turn could rent out a room. And Cornfeld could do dam near anything with it. So this could easily turn into exactly what is not wanted. After closing he could sell the remaining buildable units to another investor that would develop them with the deed restrictions. Since it is his property any deal a bank would agree to is legal.

He could flip any part of this property he cares to.

This 12.5 million is doing very little to solve the true problem of lack of housing. Had they used it to build 150 new units on already owned grown it would fix the supply part of supply and demand. With nothing to force the additional units to be built then we have not created any additional units at any rental level.

We are happy that we did not buy a property that was offered about 4 years ago. We no longer wish to buy anything in KW as I predict a serious crash in property values are in the near future again. And after all of the corruption we been alerted to not even sure if we care to visit KW. Our safety is not near what we once believed it to be.

And no it is not a good use of tax money. Perhaps even illegal without voters OK.

Take a look at Simonton trailer park and see how that went south. Maybe they are related.

About second homes for the rich: Assuming the deed restrictions are well-written and actually do run with the land and survive any type of court proceeding for bankruptcy or foreclosure, then the “affordable housing” deed restriction would apply to selling as well as renting in perpetuity. Assuming the “affordable housing” code that applies is the local Key West code– then there is a requirement that the buyers earn at least 70% of their household income in Monroe County. What it does come down to is enforcement. Who would be making sure that buyers qualify and that the sales price is within the guidelines? That the buyers are telling the truth on their disclosures? Who will make sure that the deed restrictions make their way to every new deed? Where are the built-in enforcement methods? For now we are hearing it will be the Key West Housing Authority that will vet and enforce the deed restrictions on Peary Court [“like they are doing now”], but we know that they do not actually perform these duties now although there is a Memorandum of Understanding that says they do so for all Key West privately owned affordable units. There are stories of “deed restricted” units in Key West that were sold for market rate to unqualified buyers – unbeknownst to them, stories of affordability restrictions being lost due to foreclosure proceedings because the deed restriction wasn’t well written, stories of units being rented for market rate to unqualified [or qualified] renters. One thing that should come of all this should be the understanding that we need a true method of enforcement – with communication between all government entities. At this point the system allows “affordable housing” units to go completely under the radar – City officials have been looking the other way — just telling everyone the City’s Housing Authority is taking care of it. Commissioner Sam Kaufman has been trying to shake that up…

This does open even more concerns. How many current tenants will now not qualify ? As a landlord I can tell you it is costly anytime a tenant moves out. Cornfeld will not want to boot anyone out that is now paying rent. All the current tenant needs to do if making too much income is find a way to lower it on paper. Very old trick of part of paycheck is some cash in envelope. I could easily divert my income from SS to Monroe county and white wash all other income. I manage rentals and 90 % of that can be done on computer any place I care to call home. Personally we would not even want to live that far from Duval st.

And what happens if someone qualifies to buy a unit today but does not next year ?

Not really worried about the deed restriction once recorded. That falls onto the lap of a title company at closing to disclose it.

What upsets me is is KW could create 150 additional units with this 12 million and actually fix the problem of a shortage of housing. And that would lower rents. Peary court already is getting the maximum rent it can. If it is such a money maker it would not be for sale.

And no we can’t trust the city housing authority to over see this deal. Not sure if KW has any government agents that can be trusted.

It would be perfect to have Naja as a commissioner or mayor and still run this paper. WOW a what fantastic way for voters to be kept informed. Please run. You might be the only hope we have of cleaning up corruption.

Yes indeed, Dr Larry, nice points, Martha

Wonderful information Naja and jiminkeywest, thanks for the incisive thoughts and questions. Martha